user interface · prototyping. · authoring

Every year, 600 new customer contact advisors start working at Zilveren Kruis. They are the first point of contact for customers and the face of the health insurer. At the end of each year, these people are under increased pressure: during peak weeks, around 1,200 advisors are on the phone.

TinQwise worked closely together with Zilveren Kruis to develop a blended onboarding journey that was easy to scale. The goal of the onboarding was to have dedicated customer contact advisors who could confidently answer the phone and help customers.

The result was that onboarding time was reduced by 8 hours and that there were two-thirds fewer drop-outs compared with the existing programme.

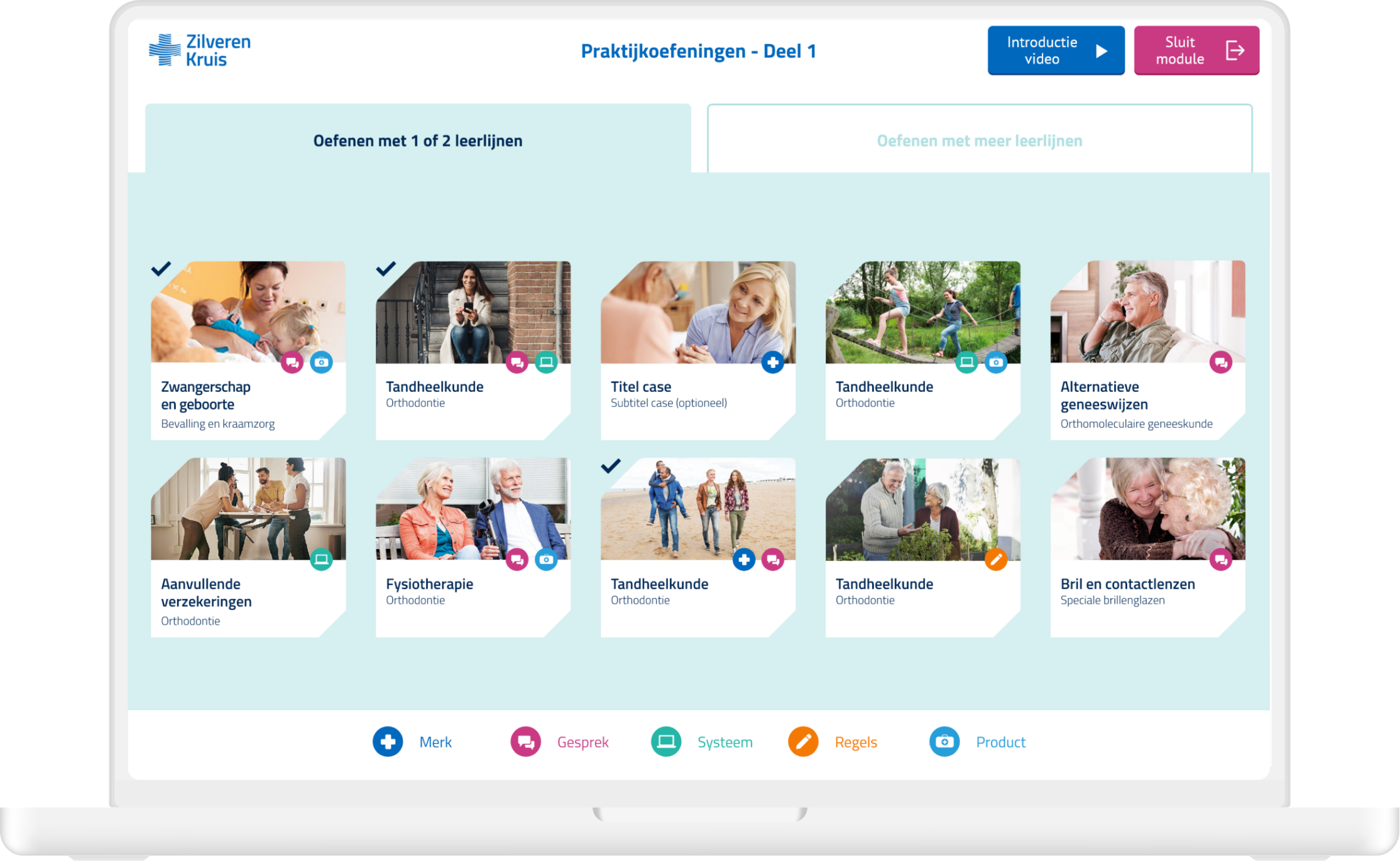

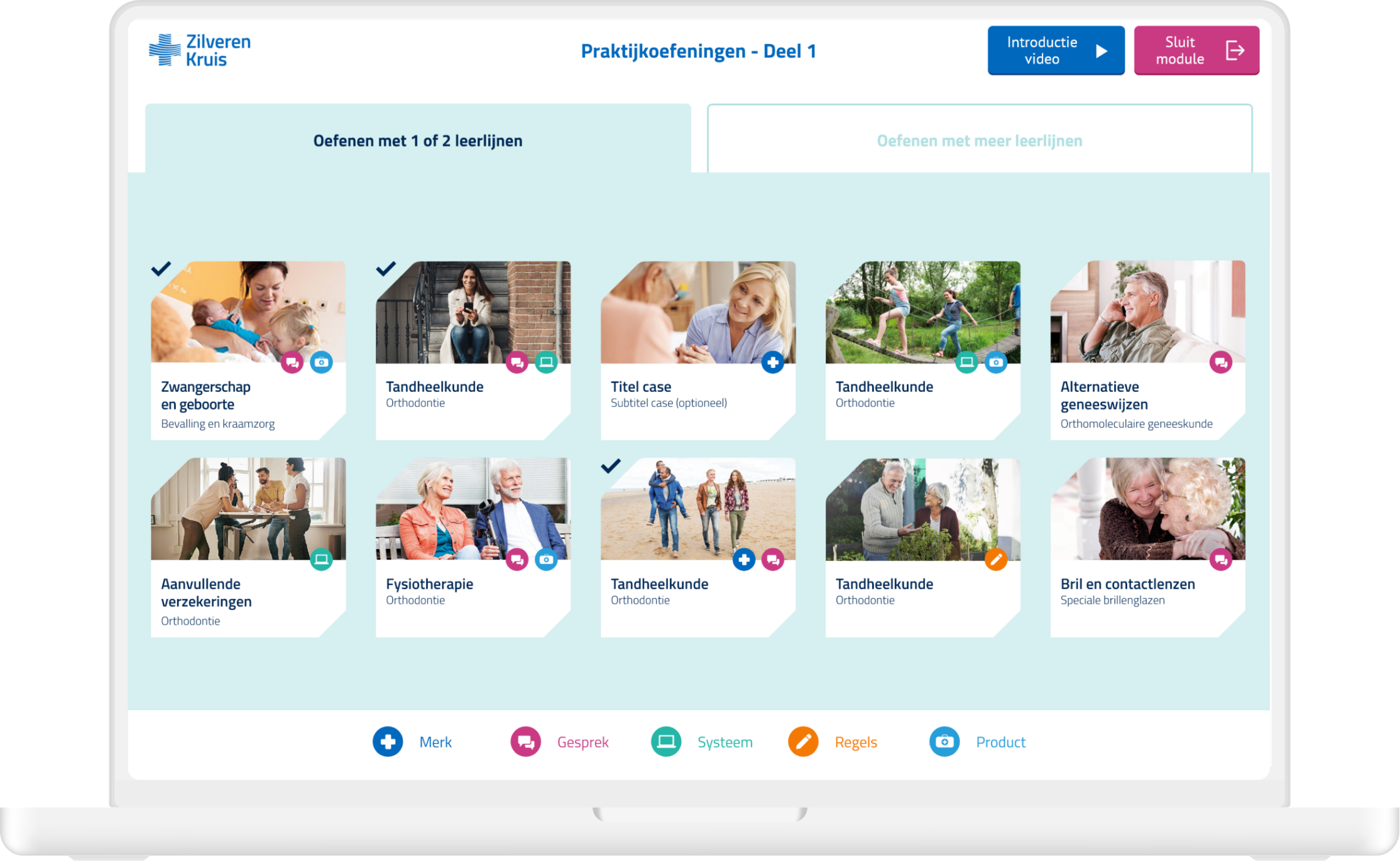

The existing onboarding programme at Zilveren Kruis consisted of six training days. All that content had to be redesigned for the new blended (i.e. online as well as offline) journey. With a dedicated scrum team from TinQwise and Zilveren Kruis, we developed three types of sample modules. Zilveren Kruis was then able to use these module concepts for other subjects.

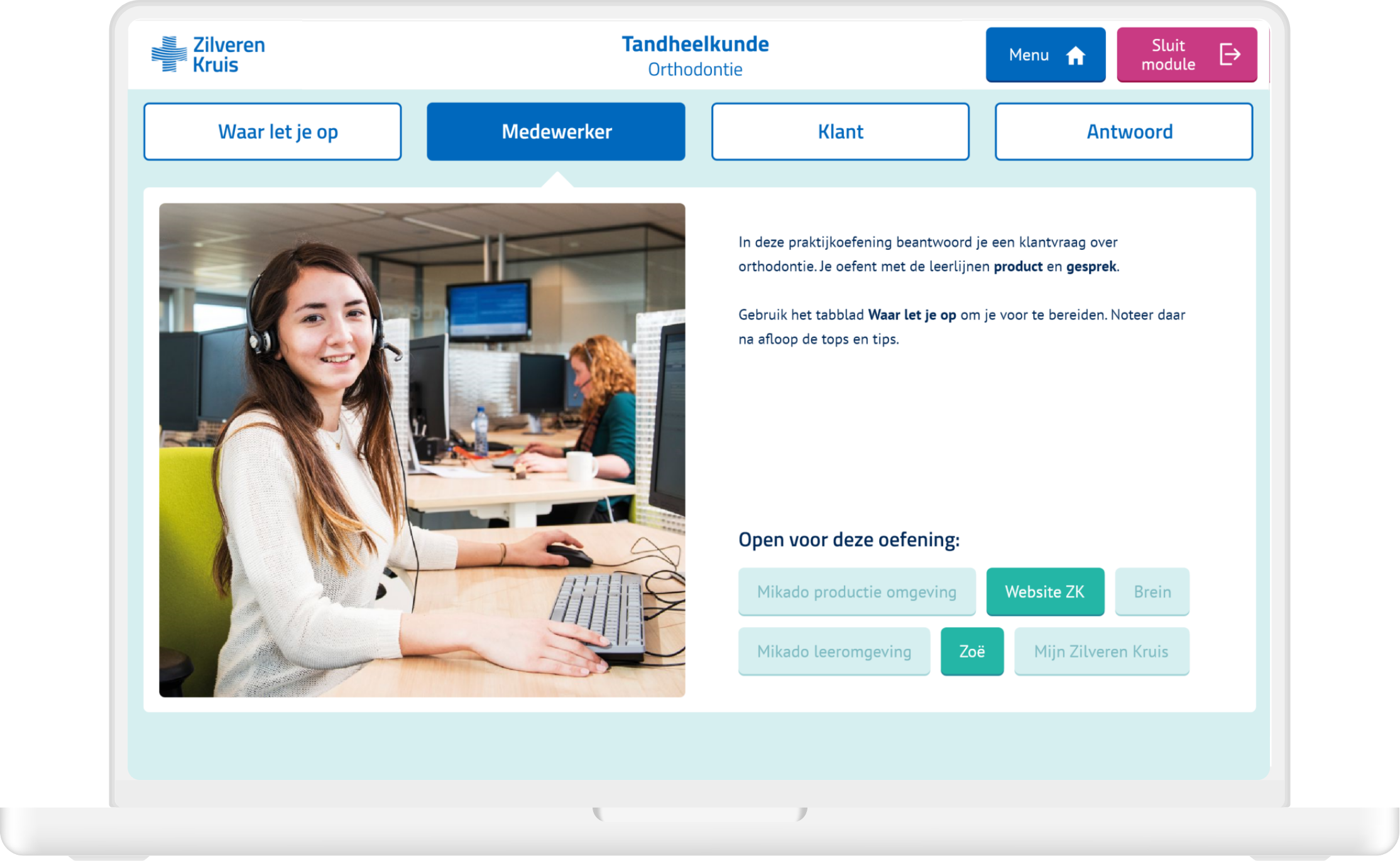

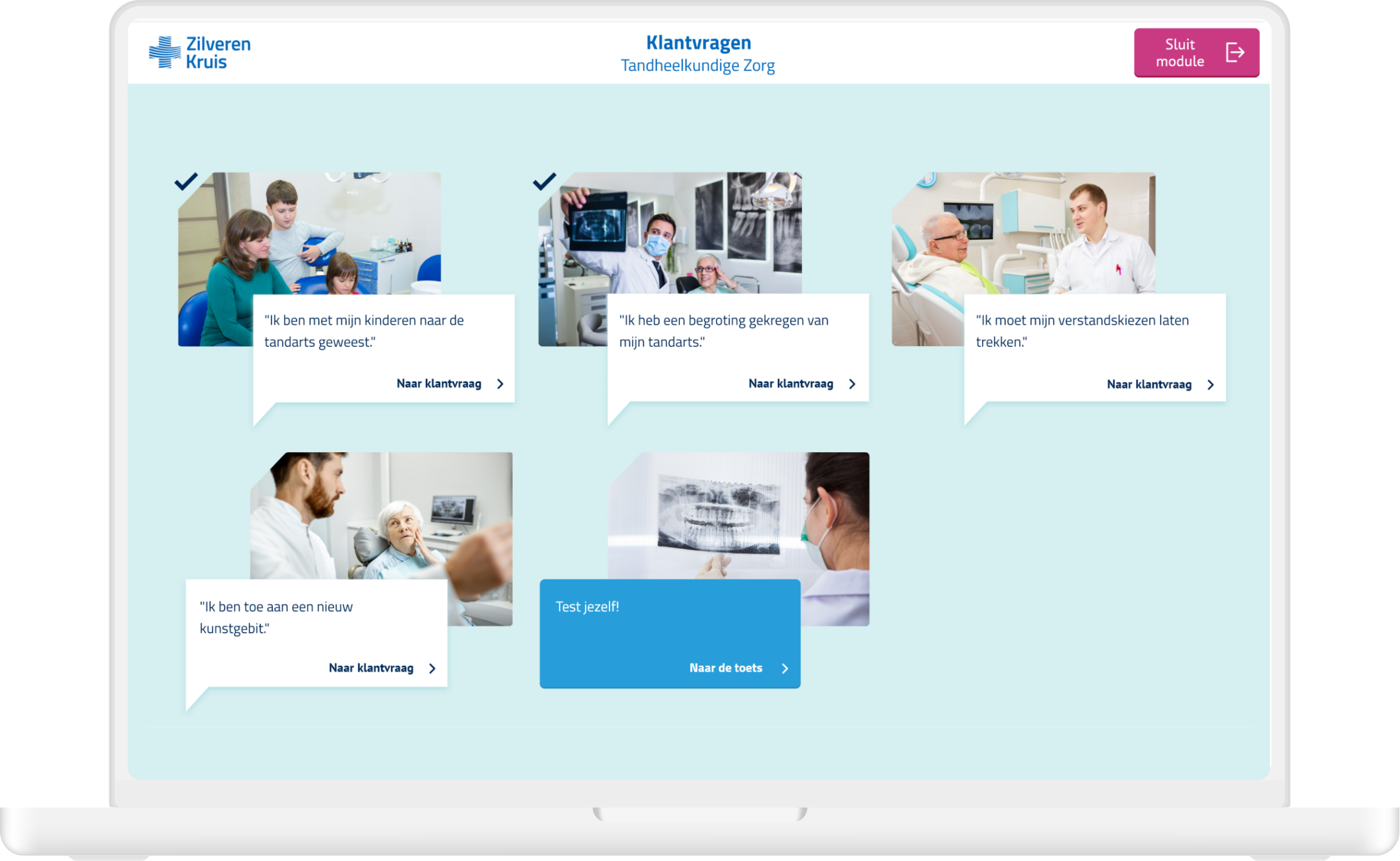

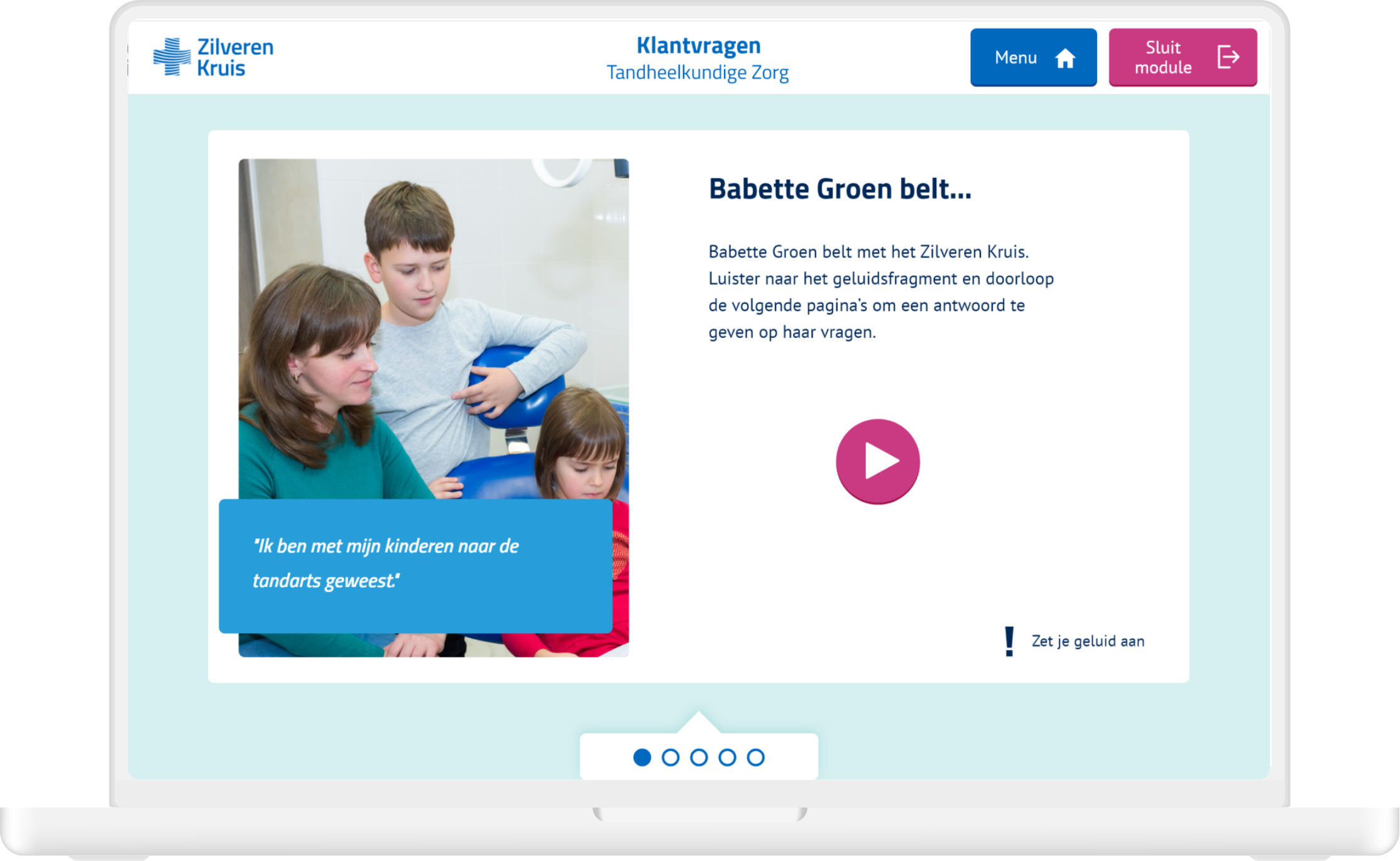

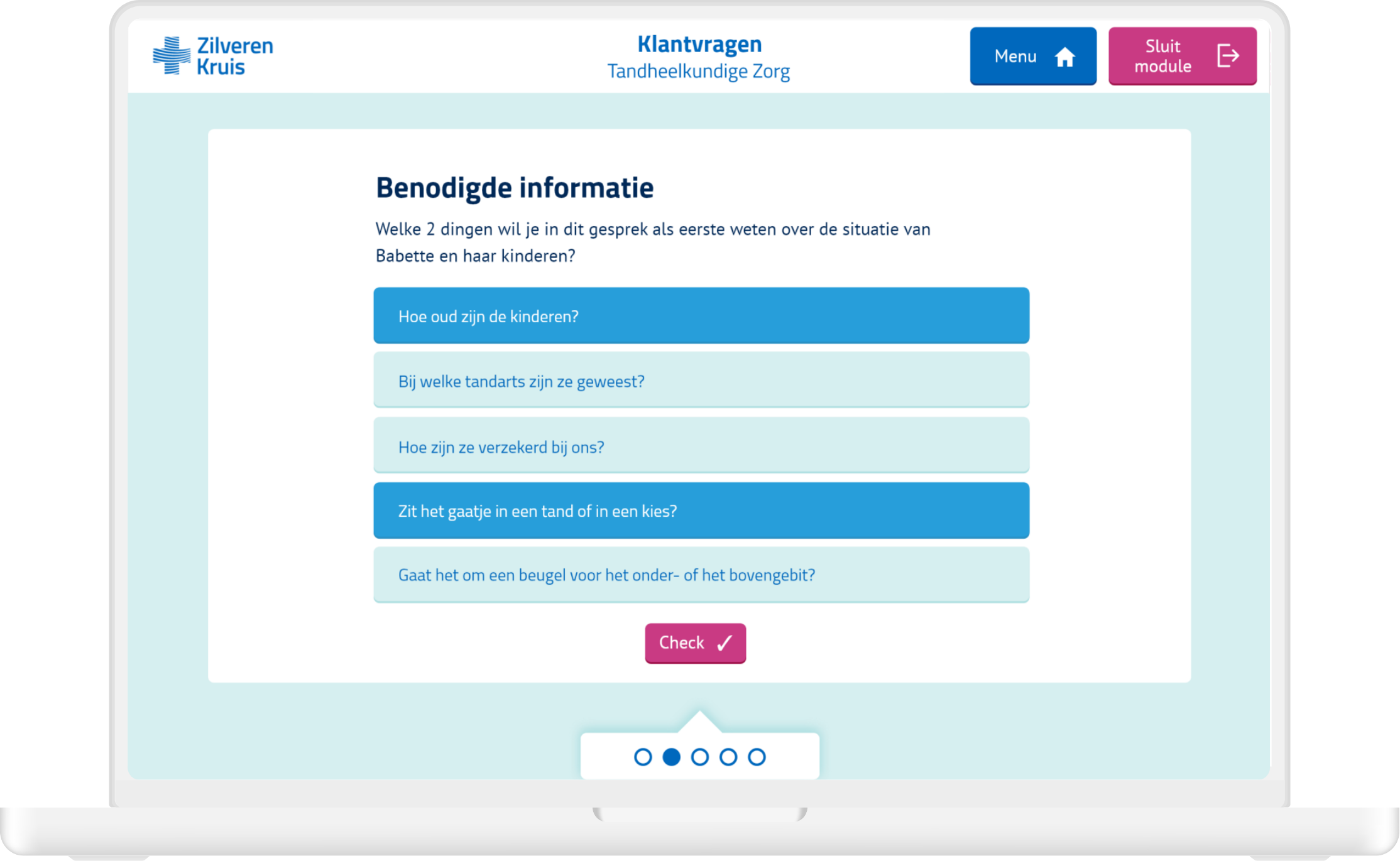

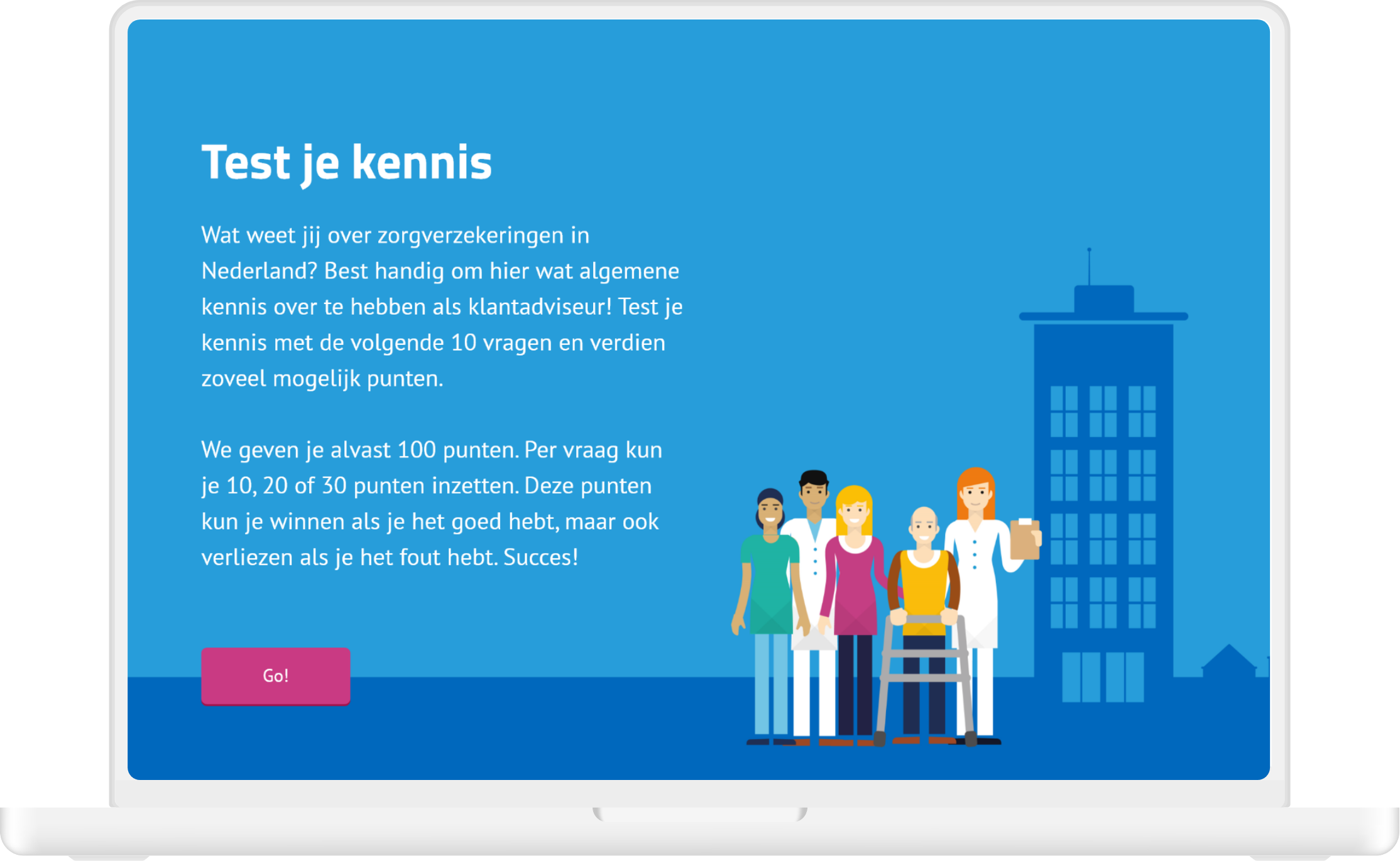

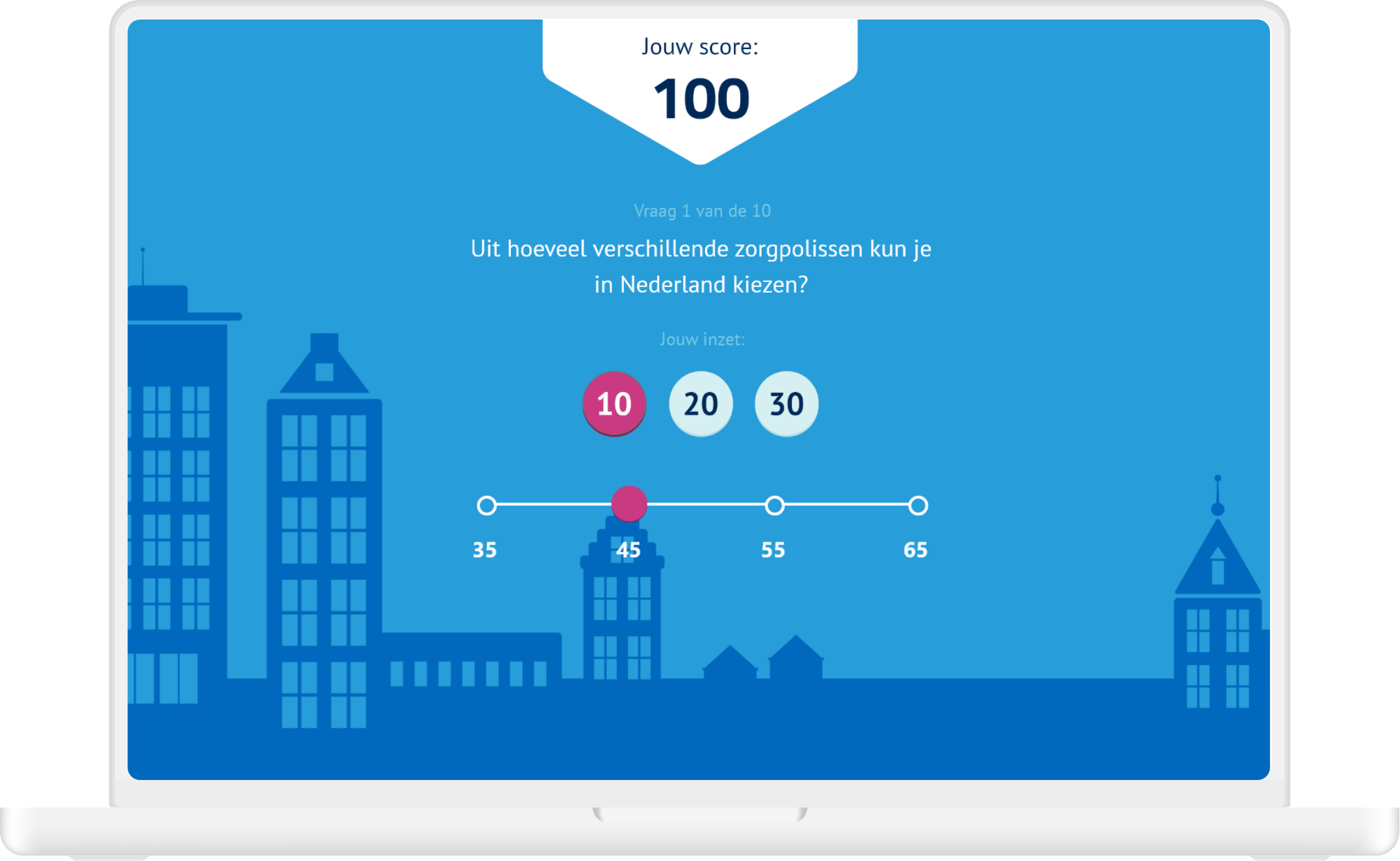

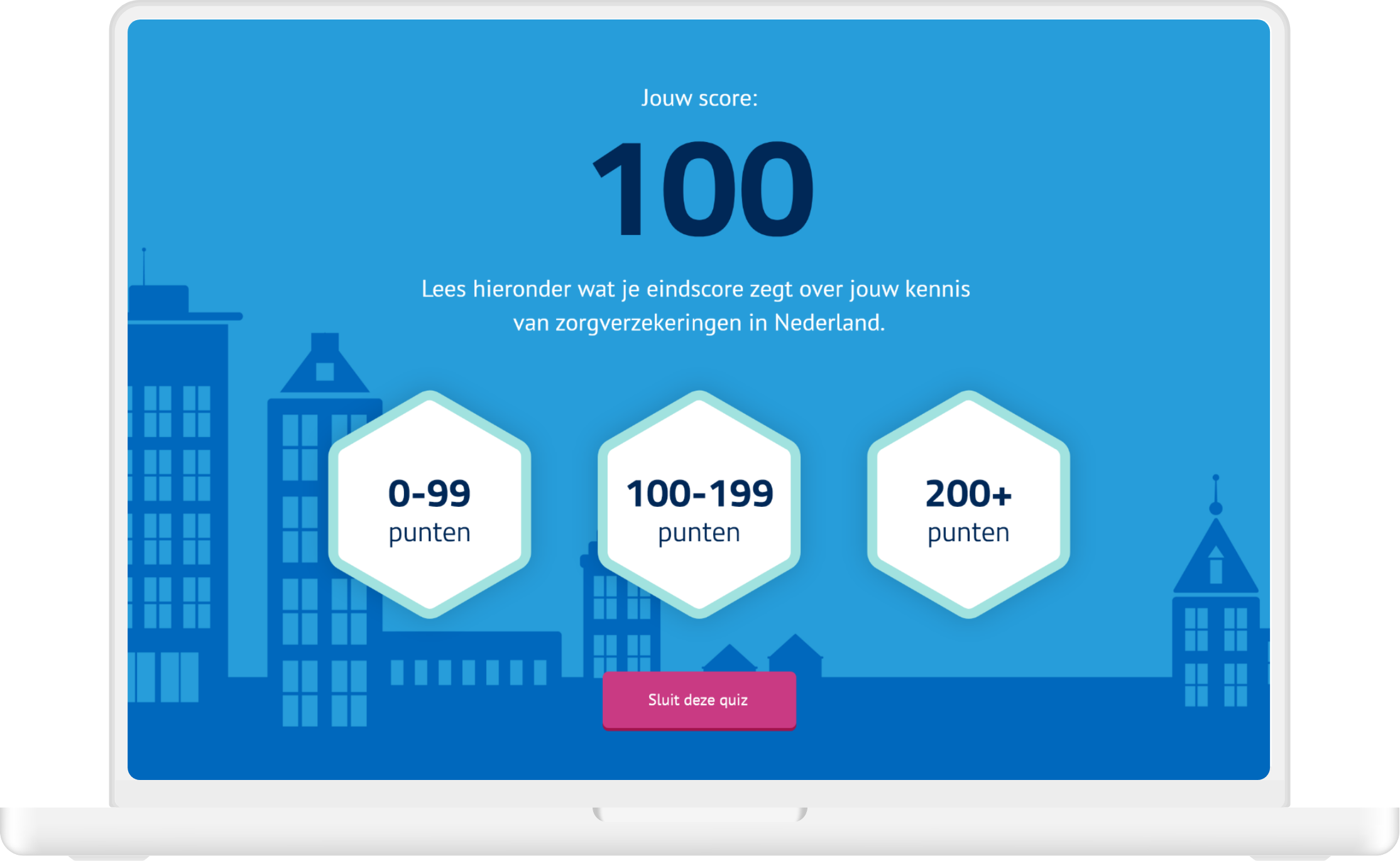

I was the single designer on this project and did all the design related work for the three sample modules. The three types of modules consisted of (1) practical exercises about customer inquiries, (2) a quiz and (3) a role playing game. I did the visual design, user interface and prototyping and also built the three modules in authoring tool Lectora. Zilveren Kruis could then use these modules as templates and only replace the content.

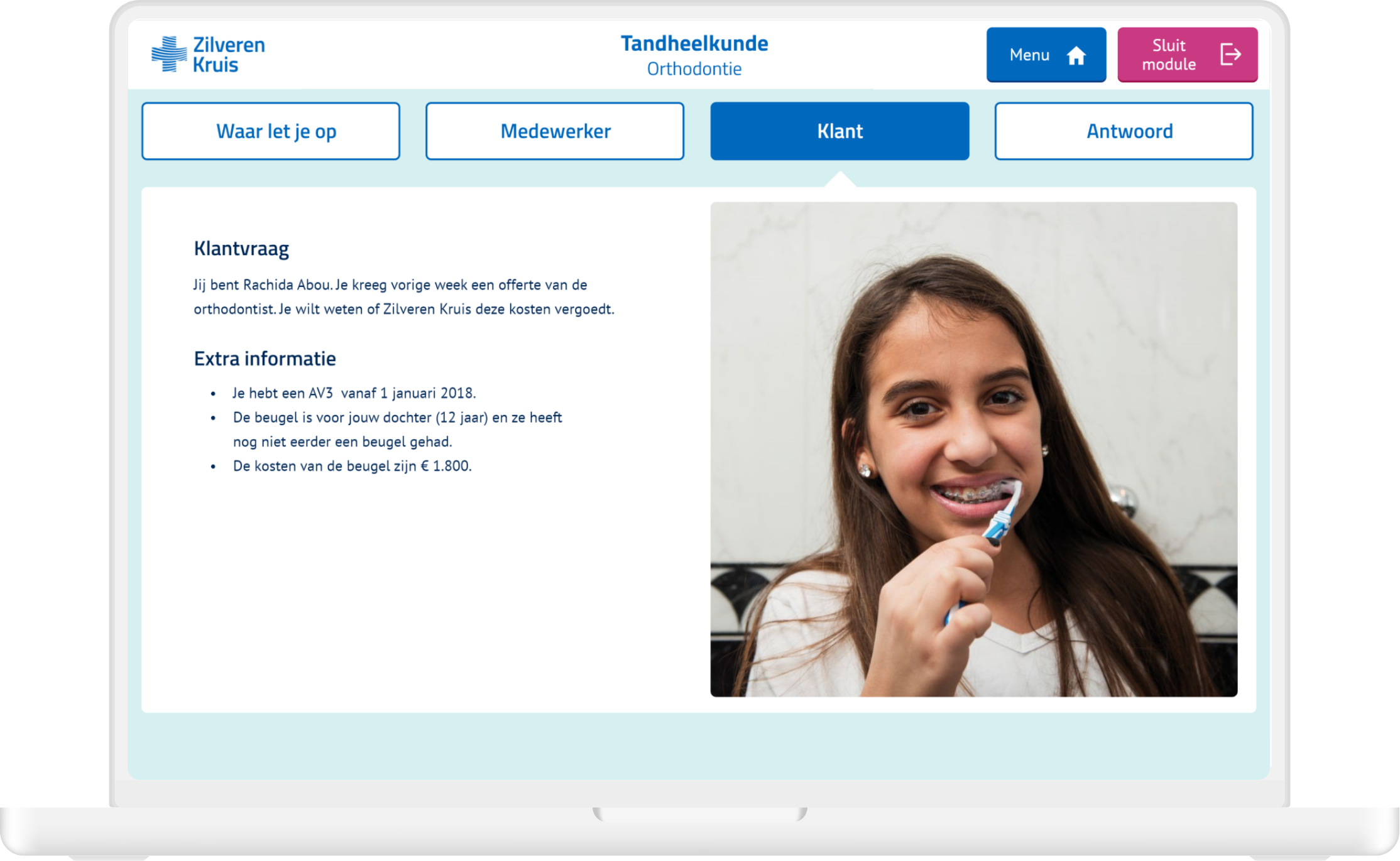

The advisors learned about different insurance topics by practising with customer inquiries. These inquiries were presented in different interactive instruction methods, such as audio or chat. Each module laid emphasis on a different type of knowledge or skill, such conversation techniques, use of applications, knowledge about the insurance policies, etc.

The advisors could test their knowledge by doing a quiz. They started the quiz with a 100 points and could ‘stake’ an amount of points on each question, which resulted in them doubling their stake if they had the question right, or losing it. At the end their score would say something about their knowledge level.

To gain as much experience as possible in conducting actual conversations, the advisors applied what they had learned through practical exercises. These were role playing games through Skype with a senior colleague, where the colleague pretended to be a customer.

During the call the advisor needed to use various applications, answer the questions fast and comprehensively and apply the correct conversation techniques.